If you have between 2-50 employees and offer group health insurance, you most likely have a fully insured plan that costs a lot of money. Or maybe you have avoided offering this crucial benefit to your employees because of high costs. Fortunately, there are now viable alternatives to high cost, ACA group plans! Self-funding health insurance plans used to be a concept only available to large employers but not anymore! Small group employers are starting to flock to self-funded plans as a way to mange their groups cost and expand their options. Small business owners can now enjoy the advantages of self-funding health insurance with many insurance carrier options. These plans offer the benefits of self-funding without forcing the groups to take on extra risk.

When you work with Georgia Health Insurance we will help you evaluate ALL the options to find the best plan at the best price.

Small Group Self-Funding Benefits.

- Reduced premiums based on underwriting that can offer 20-40%+ savings over traditional, ACA plans.

- Level premiums that will not increase for one year.

- More flexibility in plan design and quality coverage on premier insurance networks.

- Potential reimbursement of money if claims experience is good.

- Access to claims data that allows companies to know what their insurance premiums are actually paying for.

How is the Plan Priced?

The main difference between the price of a fully insured, ACA plan and a self-funded plan is in underwriting. ACA group plans cannot take any health information into account when pricing plans. All ACA plans are based strictly off broad factors such as age, location, job etc… This means the insurance carrier must price the plan expecting to have high claims experience from people that are sick. With self-funded plans, the insurance carrier is allowed to ask groups to answer health questions and then gives the group a price based on how healthy there are. Additionally, self-funded plans offer more flexibility in coverage options. Where traditional plans must offer coverage in certain areas, self-funded plans may have the option to reduce benefits in certain areas to cut cost. Many self-funded plans also offer more flexibility in plan design than their traditional counterparts.

The end result is that groups that a generally healthy can enjoy much better pricing and flexibility with self-funded plans than what ACA plans will offer. Not sure if your group is healthy enough? That is ok! We can quickly gather health information and get a quote. The savings are too good to pass up!

How Self-Funded Plans Work

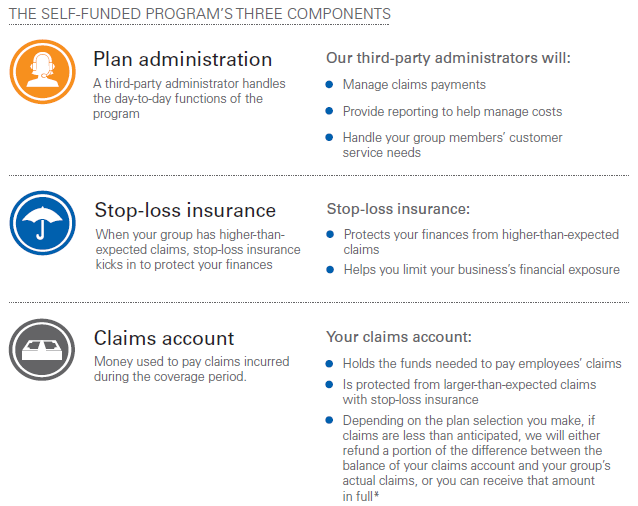

Day to day, a self-funded plan will behave like a traditional, fully insured health plan. Your employees will most likely not be able to tell the difference! The main difference is in how the insurance carrier operates the plan on the back end. Here is a chart that shows the three components of many self-funded plans:

Self-Funded Compliance

Most of the compliance requirements carry over from traditional plans. You can read more about basic compliance requirements HERE. In addition, self-funded plans are subject to the following fees and report filings:

PCORI Fees – This is a minor government imposed fee on self-funded plans. It is currently $2.39 a person, per year. You can view the filing deadlines and fee amount HERE. Some carriers will pay this fee for your, some assist in paying it and others require you to take care of it. Either way we will make sure you know what to do.

1095 Filing – This is a reporting requirement for self-funded plans. It basically lets the government know how many people are on self-funded plans. Here are the filing requirements. However, like the PCORI fees, some insurance carriers file this for the groups. We will make sure you know what is needed in regards to these filings.

What about Balance Billing?

Balance billing is when the charged amount exceeds the covered amount and the insured is sent a bill for the difference. This becomes a non-issue if you choose your insurance carrier wisely. The best self-funded insurance providers will provide guarantees that they will not balance bill members. Instead they will negotiate with the medical provider and come to an agreement on what they will pay, the member would never be involved. Sometimes a member can get balanced billed without the insurance carrier knowing. If a member does get balance billed they should report it to the insurance company as soon as possible so the insurance provider can take care of the balance bill for them.

How do you get Quote? We make it easy with FormFire!

Getting quotes for self-funded plans is more work than getting quotes for traditional, ACA plans. Your employees must complete an application that asks health questions as the plan pricing is partially based off of your groups health. However, we have streamlined this process by having one, digital application (FormFire) that will allow us to quote ALL the major self-funded carriers in Georgia! The application is VERY quick and it is easy to set up. In the past, in order to get self-funded quotes you needed to fill out an application with each carrier JUST to get quotes. Our system is a vast improvement over the the old way of doing self-funded.

What do you Have to Lose?

Money. You may very well be leaving money on the table by not using a self-funded plan. You can schedule a quick, 15 minute consultation with Daniel and find out if a self-funded plan could be a good fit for your company. The ability to offer great coverage at an affordable price can not be overlooked! Do not give the insurance carriers extra money when there is a better option!

What Else do we Offer?

Not only will we help you find the best plan at the best price, we will go the extra mile to ensure you have the best possible experience as our client. We offer:

- The best customer service in the state of Georgia!

- Help with ancillary products like group dental, vision, disability and life insurance.

- Ongoing help administering their group plan and free software like https://www.hr360.com/.

- A free online enrollment and benefit management system, employee navigator.

- Help ensuring your group is compliant with government regulations. We will create your SPD document for a small fee.

- Continued monitoring of new plans and options for your group health and help evaluating your renewals.

- We can help your employees that are approaching 65 with Medicare for free!

- Payroll company recommendations and integrations with our system.

LEARN MORE HERE!

Contact Us Today!

770-452-9335